Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

IMPACT OF INFLATION ON THE INDIAN ECONOMY (MAY 2018-APRIL 2019)

INFLATION??

Inflation is a quantitative proportion of the rate at which the average price of chosen goods and services in an economy increases over some undefined time frame. It is the consistent increase in the general level of price where a unit of currency buys short of what it did in earlier periods. Frequently communicated as percentage, inflation shows a decrease in the purchasing power of a nation’s currency. A normal inflation rate for a country is about 2-3%. The highest rate that has been ever recorded in the history of India has been September 1974, where the rate touched 34.70%(Source: www.inflation.eu) . The current rate is 3.80%, which implies that the government is printing more money in order to take care of its revenue and expenditure.

CAUSES OF INFLATION:

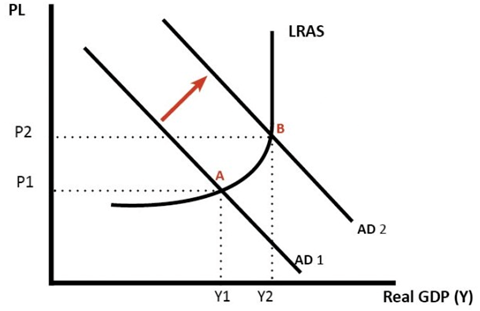

When the aggregate demand is greater than aggregate supply, the demand pull situation arises. If this situation arises, it means that the economy is growing at a fast pace. At this stage, if the economy is close to employment or there is full employment, then a rise in aggregate demand leads to a rise in general price level. As firms achieve full employment, they react by setting up costs prompting inflation. Additionally, near full employment with labor deficiencies, workers can get higher wages which increment their spending power. If economic growth is above long run trend rate of growth that’s when demand pull inflation is evident.

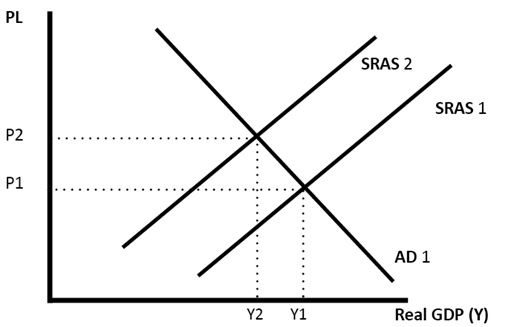

2). Cost push inflation-

An increase in the expenditure made by firms will lead to an increase in prices for buyers also because at this stage the organizations pass the rise in expenses towards the consumers. There will be a leftward shift in the aggregate supply.

(Source: www.economicshelp.org)

3). Increase in money supply-

An excess money supply situation by the central bank will lead to a rise in inflation and general price levels and this in turn will cause problems to the consumers that exist in the market. If there is excess supply of money, a situation called “Hyperinflation” arises, which is one of the major problems an economy can face.

ADVANTAGES OF INFLATION:

1). Deflation can be a bane-

People tend to postpone their purchases assuming that the prices will decrease in the near future in case of deflation. This leads to a stop in circulation of money causing the economy to fall.

2). No debt burden-

The ideal inflation rate is expected to be 2%, while taking a debt. If the rate deflates instead of inflating, people will further be forced to pay a higher debt. Therefore, it increases their debt burden.

3). Growth boost-

A country suffers from recession when the inflation rates are low. Most of the countries set a target to maintain a moderate rate of inflation so that it can push the circulation of money in the economy.

DISADVANTAGES OF INFLATION:

1). Reduces investment-

If the inflation rates are low then firms take the opportunity to risk and invest, which improves stability but since the future cannot be predicted, people fear investing money and losing it later. This in turn reduces investments.

2). Reduces value of savings-

If interest rates are lower than inflation rate, people who save money are more likely to suffer the most since they do not get the required amount of interest.

3). Uncompetitive economy-

If the inflation rates are high, they can make a country’s economy uncompetitive. It will cause a downfall in exports, thereby leading to a current account deficit and lower economic growth.

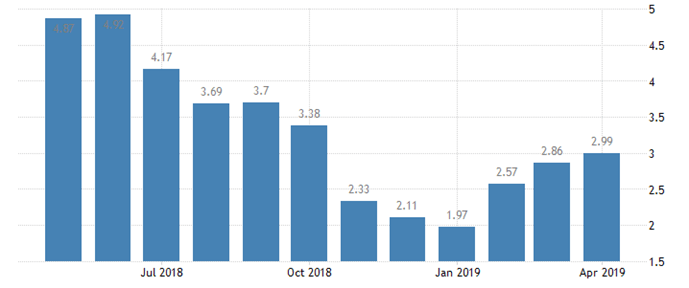

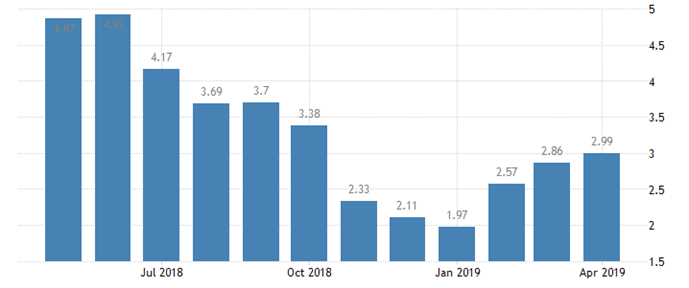

INFLATION RATES (May 2018 – April 2019):

(Source: tradingeconomics.com)

IMPACT ON INDIAN ECONOMY:

1). Retail inflation-

The data as per May 2019 is 3.05% (seven-month high). A rise in food and vegetable prices have led to a rise in retail inflation for four continuous months, which is determined based on Consumer Price Index(CPI). (Source: www.businesstoday.in Published: June 12, 2019)

2). Index of Industrial production (IIP)-

3). Effects on goods-

| Goods (April 2019) | Rate |

| Primary goods | 5.2% |

| Capital goods | 2.5% |

| Intermediate goods | 1.0% |

| Infrastructure and construction goods | 1.7% |

| Durable goods and non-durable goods | 2.4% and 5.2% |

(Source: www.businesstoday.in Published: June 12, 2019)

SECTORS BENEFITED DUE TO HIGH INFLATION:

1). Daily utilities-

Example- A rise in the price of medicines or water will not affect the consumer because he will have to buy them, the reason being that they are necessary for them.

2). Raw material-

3). Gold stocks-

4). Oil stocks-

MEASURES TO CONTROL INFLATION:

1). Monetary Measures-

2). Fiscal Measures-

3). Price Control-

CONCLUSION

Inflation is one major issue which affects the Indian economy. The current GDP of India is 7.3%. It is likely to increase to 7.5% in the coming year. With inflation persisting in the economy, it will be difficult for the economy to gain its GDP. Investors should wisely invest in the sectors which would give them adequate returns even if inflation persists in the economy. The RBI should ensure to take proper measures to control inflation so that it can cover up its spending and expenditure.

BIBILOGRAPHY

Media, T. (n.d.). Historic inflation India – CPI inflation. Retrieved from https://www.inflation.eu/inflation-rates/india/historic-inflation/cpi-inflation-india.aspx

India Inflation Rate. (n.d.). Retrieved from https://tradingeconomics.com/india/inflation-cpi

Causes of inflation. (n.d.). Retrieved from https://www.economicshelp.org/macroeconomics/inflation/causes-inflation/

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.